September 12, 2025 . InvestAgile

Education Inflation

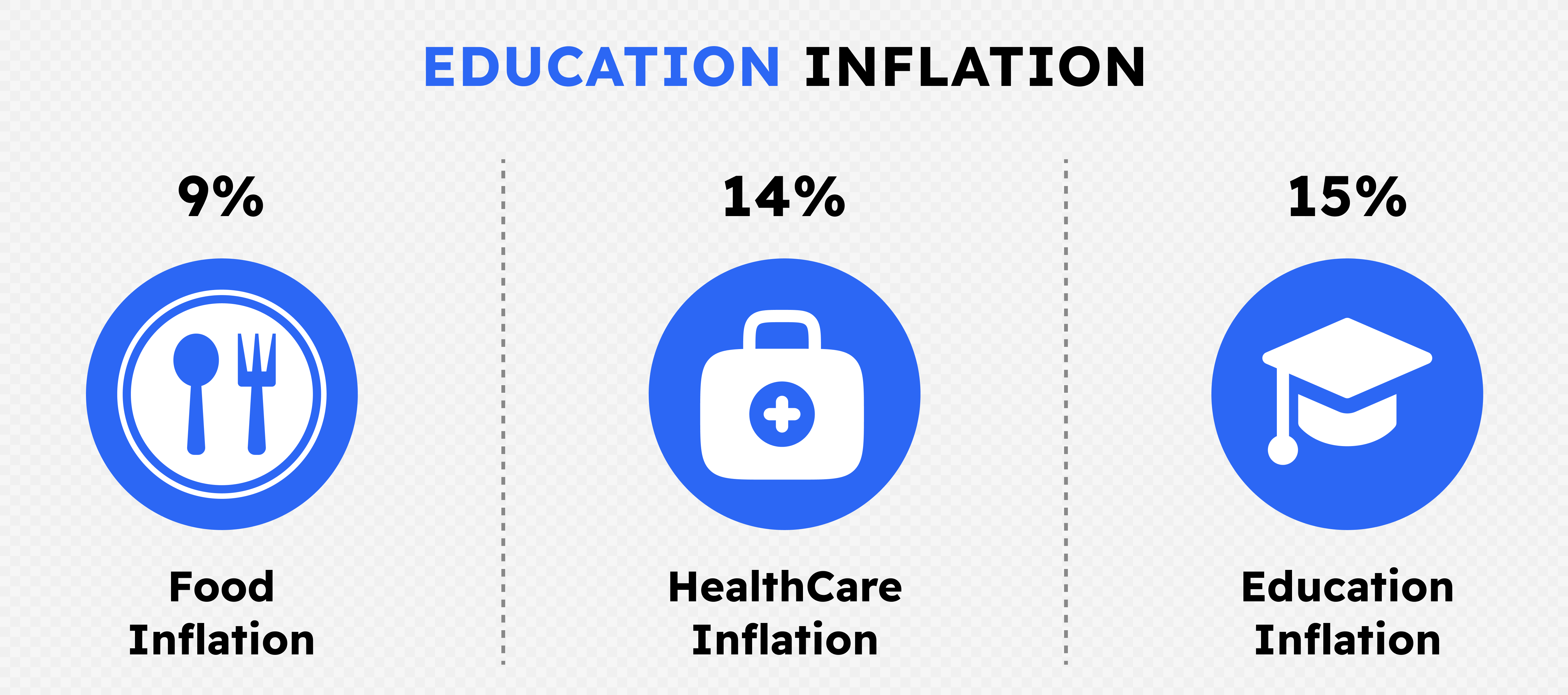

Every parent aspires to give their children the best possible education, one that will set them on a path to success and personal fulfilment. However, quality education comes with significant financial commitments, especially in a world where education costs are rising at an alarming pace. In India, the education inflation rate hovers around 15%, meaning the cost of education doubles every six years. Without proper planning, covering these costs can strain family finances.

Why Education Planning is Crucial:

Education not only shapes a child's future but also defines their opportunities in life. Given the rapidly rising costs, parents must take a financially diligent approach to plan for this major life goal. A postgraduate course costing INR 10 Lakhs today could soar to INR 50 Lakhs in the next fifteen years. This stark increase underlines the importance of creating a comprehensive education fund that accounts for factors like inflation, taxation, and liquidity.

Key Components of Education Planning:

Start Early to Benefit from Compounding: The sooner you start saving and investing for your child’s education, the more you can leverage the power of compounding. Small investments made early can grow significantly over time, reducing the financial burden closer to your child’s higher education years.

Set an Inflation-Adjusted Education Goal: Given that education costs in India are rising by about 12% per year, it’s critical to factor in inflation when setting your education goals. Without accounting for inflation, you might fall short of the required amount. An education fund targeting INR 10 Lakhs today should aim for at least INR 50 Lakhs in the next fifteen years to cover the same education costs in 2039 given the education inflation rate 15%.

Focus on Equity Considering Risk Profile & Time Horizon: Equities tend to offer higher returns over the long term. For education planning, especially for younger children, a focus on equity investments can be a powerful strategy. By starting early, parents can take advantage of the long investment horizon to smooth out market volatility and benefit from growth.

Consider Guaranteed, Risk-Free, and Tax-Free Investment Options: While equities should form a part of your education fund, it’s also wise to include some guaranteed, risk-free investments leveraging the tax benefits at the same time.

Invest More Every Year: Increasing your annual investments gradually will help meet the growing financial demands of education as your income grows.

Review Your Plan Regularly: The financial landscape is dynamic, influenced by both domestic and global economic shifts. Periodic reviews of your education plan are essential to ensure it remains aligned with your long-term goals and the current market conditions. Adjustments may be necessary based on changes in your financial situation, risk tolerance, or investment performance.

Additional Strategies for Effective Education Planning:

Leverage Tax Benefits: By choosing investment options that offer tax exemptions or deductions, you can optimize your savings. Plans like ULIPs (Unit Linked Insurance Plans) and ELSS (Equity Linked Savings Schemes) not only help in wealth creation but also provide tax relief as applicable under the tax laws prevailing.

Diversify Your Investments: Diversification is key to managing risk in any long-term investment strategy. Along with equities, include debt instruments like bonds or fixed deposits to ensure a balanced portfolio. This way, your education fund remains resilient even during market downturns.

Consider the Cost of Global Education: If you aspire to send your child abroad for higher education, it’s important to consider currency fluctuations and the cost of living in other countries. Start planning early for international education expenses, as these tend to rise faster than domestic costs.

Summary:

Planning for your child’s education requires foresight, strategy, and consistent effort. With the rising cost of education in India, an inflation-adjusted approach is crucial to ensure that you can meet future expenses without compromising on other financial goals. By starting early, focusing on diversified investments, leveraging tax benefits, and regularly reviewing your plan, you can secure your child’s future and provide them with the best possible opportunities for success.

Please feel free to reach us for our expertise on Education Inflation.

Recent Post

Business

Risks are an inevitable part of success, and every business faces challenges that can hinder its goals. The...

Education Inflation

Every parent aspires to give their children the best possible education, one that will set them on a path t...

Cyber

In today’s digital landscape, mitigating cyber risks is critical to safeguarding an organization's data a...